Centuria Capital Group (ASX:CNI or Centuria) announce:

- Centuria issued a takeover notice confirming its intention to make a full takeover offer to

acquire the remaining shares in Augusta Capital Limited for NZ$130 million - If successful, Centuria AUM will increase by 24% to AU$8.9 billion

- Augusta shareholders that accept the proposed offer will receive NZ$0.20 in cash and 0.392

of a Centuria Stapled Security in exchange for each of their shares in Augusta - Supported by Augusta’s founding shareholders and other Augusta shareholders who,

together with Centuria’s shareholding, represent 42.2% of Augusta’s total shares on issue - The Transaction is to be funded by Centuria scrip and cash reserves

Transaction Overview

Centuria Capital Group (ASX:CNI or Centuria), which presently holds 23.3% of the ordinary shares of Augusta Capital Limited (Augusta), has today lodged a takeover notice confirming its intention to acquire the remaining shares (the Transaction). The Transaction will be implemented by way of a full takeover offer under the New Zealand Takeovers Code (Offer)1.

The Transaction is part of a long term strategy and complements Centuria’s existing expertise in the Office and Industrial markets with approximately 72% of Augusta’s assets under management (AUM) invested in these two sectors as well as diversifying Centuria’s funds management revenues through an exposure to the New Zealand office and industrial sectors. If the Offer is successful, Centuria would reinforce its position as one of the leading funds management platforms in the Australasian region.

Centuria’s current 23.3% shareholding in Augusta was acquired in May this year via a capital raising by Augusta at NZ$0.55 per share.

The Offer is also supported by Augusta’s founding shareholders (Managing Director Mark Francis and fellow founder Bryce Barnett) and other Augusta shareholders who, together with Centuria’s shareholding, represent 42.2% of Augusta’s total shares on issue.

Offer Consideration

Augusta shareholders will receive NZ$0.20 in cash and 0.392 of a Centuria Stapled Security (Scrip Consideration) in exchange for each of their shares in Augusta. Based on the five day VWAP for Centuria Stapled Securities as at 12 June 2020 of $1.914 per stapled security and an assumed exchange rate of AU$1.00:NZ$1.067, the implied offer price is NZ$1.00 per Augusta share (Implied Offer Price).

The Implied Offer Price will be reduced by any future dividends or distributions declared by Augusta in respect of the period commencing after 15 June 2020.

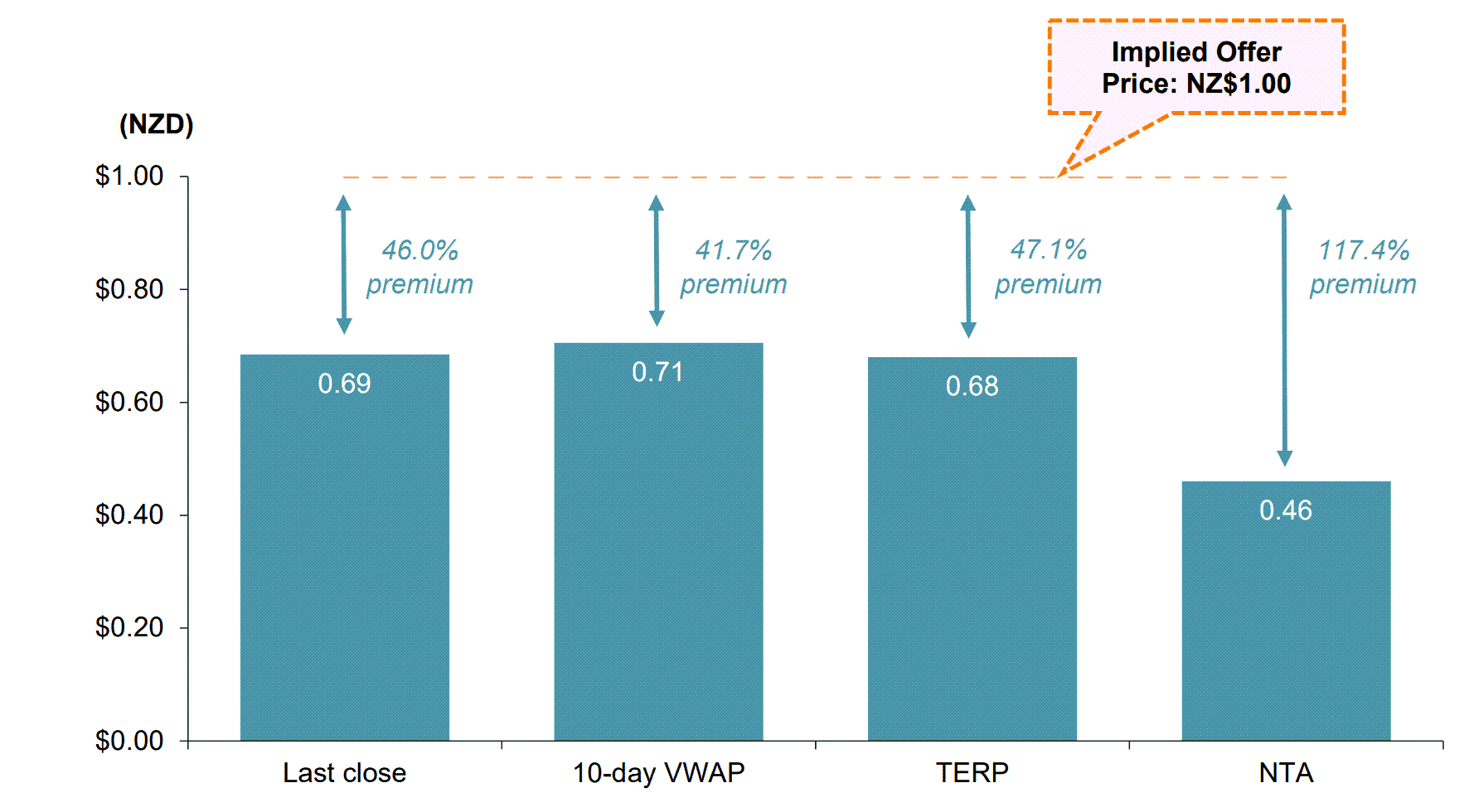

Offer premium

The Implied Offer Price of NZ$1.00 per security represents a 46.0% premium to the closing price of Augusta shares of NZ$0.69 on 12 June 2020 (being the last trading day before this announcement was made). Centuria believes the Implied Offer Price represents an attractive premium to Augusta’s recent trading price and key metrics.

Premium Analysis2

Centuria’s Joint CEO John McBain said “An acquisition of the remaining interest in Augusta is consistent with our

strategy and the two groups are extremely compatible. This strategy is based on a positive post COVID-19 outlook and Centuria will benefit greatly from a 24% increase in AUM as well as a broad Australasian footprint. Recently, the Augusta Board and management team took decisive action to minimise the impact of COVID-19 by significantly reducing corporate debt and releasing surplus cash to aid growth in the core businesses. Accordingly, its NZ platform is now well placed to take advantage of opportunities as COVID-19 unwinds.”

Benefits to new and existing Centuria securityholders

The Transaction is expected to provide a number of benefits to new and existing Centuria securityholders:

- Increased scale and relevance. Centuria’s assets under management will increase by a further 24% to AU$8.9 billion. The issuance of the Scrip Consideration will increase Centuria’s market capitalisation to over AU$1.0 billion which enhances the potential for ASX 200 inclusion.

- Combination of two complementary real estate platforms. Augusta is one of New Zealand’s largest listed funds managers with expertise in the New Zealand office and industrial sectors and an excellent long-term track record. The combined group will have greater asset sector diversification and will open new distribution channels across Australia and New Zealand.

- Financially attractive. The formation of the combined group will expand recurring real estate revenues and listed and unlisted funds. In addition, there are potential revenue and cost synergies available by deploying Centuria’s balance sheet and the rationalisation of systems.

- Diversifying into New Zealand real estate. New Zealand is a well recognised and comparable real estate market to Australia. The formation of the combined group immediately establishes a market leading regional platform, taking advantage of Trans-Tasman investor appetite for similar funds. It provides significant exposure to the robust Auckland office and industrial markets.

Conditions

The Offer, when made, will be subject to conditions including:

- Augusta shareholders accepting the Offer for at least 90% of Augusta’s shares;3 and

- Other customary conditions including prohibitions on changes to Augusta’s capital structure,

prohibitions on distributions (without Centuria approval), requirements to operate the Augusta

business in the ordinary course and the absence of material adverse changes.

The Offer is not conditional on receipt of New Zealand Overseas Investment Office (OIO) consent, as this

has been obtained already.

Additional Information

Additional information about the Transaction is contained in the CNI investor presentation released to the ASX today.

Centuria securityholders do not need to take any action in relation to the Transaction.

- The bidder is Centuria New Zealand Holdings Limited, a wholly-owned subsidiary of Centuria.

- Raising price and theoretical ex-rights price (TERP) as announced by Augusta as part of its 5 May 2020 equity raising.

- Centuria may waive this condition. If it does so, the offer would be conditional on Centuria obtaining acceptances for Augusta shares carrying more than 50% of Augusta’s voting rights.